Posts Tagged ‘taxes’

Tax Burden Made Worse by Coronavirus

Taxes seem to be a controversial topic in our modern times for some reason. Even before the Coronavirus pandemic, the topic of property and income taxes seemed to set people…

Read MoreNew York City is a Liberal Paradise

Democrats love to pretend that their pet project cities full of liberal policies and values are slices of heaven on Earth. They’re delusional. New York City is a perfect example.…

Read MoreThe Cost of Big Government

If you work for a living, odds are you’ve looked at your paycheck at the end of the month and been annoyed at how much of your money the federal…

Read MoreThe Federal Government Paid Deceased Recipients $11.6M

The government is wasting your tax dollars again, shocking right? Well, unless you’ve been living under a rock your whole life, this is nothing new. The Government insists that they…

Read MoreMedicare for All? More like Bankruptcy for All

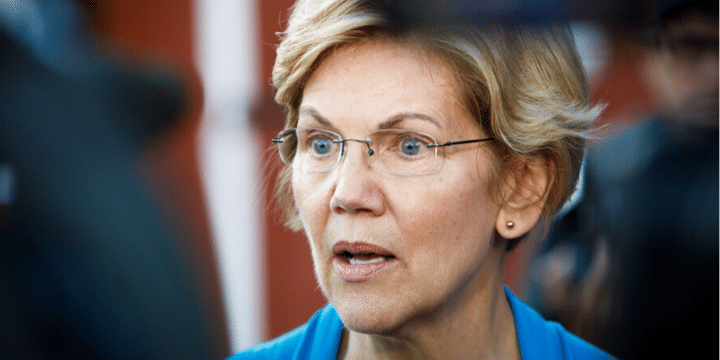

Elizabeth Warren has spent her entire presidential campaign dodging, with Muhammad Ali like precision, the question of how she intends to pay for Medicare for All. She has consistently claimed…

Read MoreFreedom Caucus chairman wants the corporate tax rate to drop down to teens

House Freedom Caucus Chairman Mark Meadows (R-N.C.) wants Congress to pass legislation that would drop the corporate tax rate from the current 35 percent down to the teens. The Hill…

Read More